Lower Taxes Mean Bigger Advantage for Arkansas

September 20, 2023Taxes in Arkansas were recently cut (again), making our state even more competitive when it comes to business growth and talent attraction.

In early September, Governor Sarah Huckabee Sanders called a special session of the Arkansas General Assembly to consider additional tax cuts. Under Governor Sanders’ leadership, the Legislature has cut the state’s top personal income tax rate from 4.9% to 4.4% and cut the top corporate income tax rate from 5.3% to 4.8%.

This is just the latest set of tax cuts making Arkansas more and more competitive.

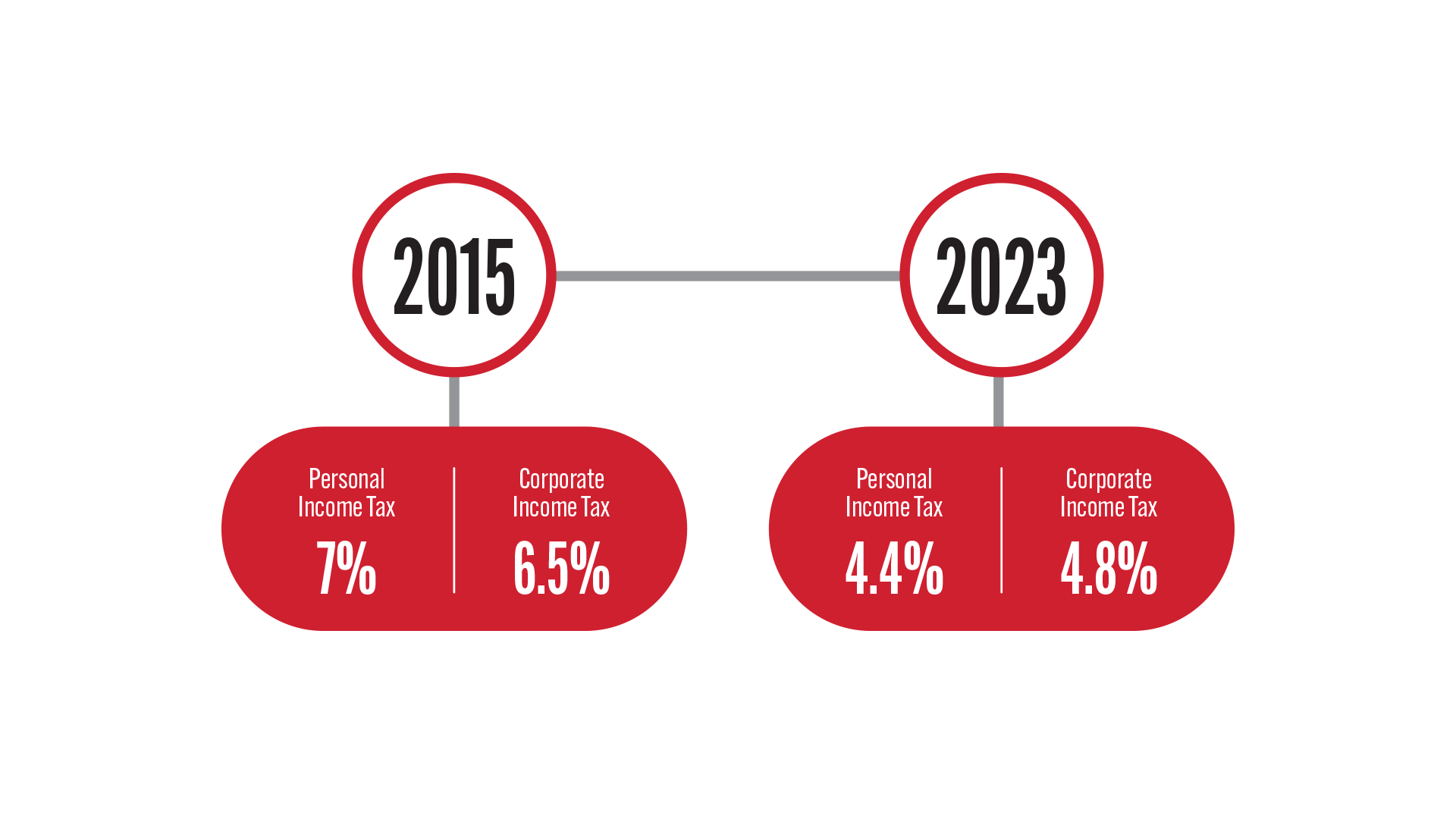

Since 2015, Arkansas has steadily cut taxes in every legislative session, as well as in multiple special sessions. The top personal income tax rate in 2015 was 7%, while the top corporate income tax rate was 6.5%. With the latest cuts, the personal income tax rate has been cut by 37% and the corporate income tax rate has been cut by 26% over the past eight years.

Cutting personal and corporate income taxes is essential for growing our state’s economy, helping Arkansans build wealth, and attracting new and expanding businesses to our state.

At AEDC, we are responsible for recruiting companies to grow in our state and encouraging existing businesses to stay and expand. When companies are looking for their next location or evaluating an expansion, they consider a wide range of factors, from workforce to available land and buildings to business climate. Taxes are a major part of an area’s business climate, and lower taxes make a state more competitive.

Economic development is a team sport, and it’s also a competition. We are competing with other states and regions for economic development projects – and we’re looking to win more than our fair share. After all, Arkansas has what companies are looking for: an experienced workforce with a pipeline of future talent, strong existing industries, and a friendly regulatory environment. By lowering our taxes, we are putting our state in line with surrounding states and increasing the advantages that we have when pursuing projects.

Tax cuts show that Arkansas is a stable place to do business. We have a balanced budget as mandated by law, and we have a surplus of more than $1 billion. Governor Sanders and the Legislature are responsibly cutting taxes to give that money back to Arkansas taxpayers while meeting the needs of the state.

In a recent op-ed for the Arkansas Democrat-Gazette, Secretary of Commerce Hugh McDonald laid out the business case for why these tax cuts help in attracting companies to our state. These tax cuts help bring businesses to Arkansas while also helping everyday Arkansans.

“The bottom line matters. Companies make business decisions in the long-term interests of their investors. The proposed tax cuts will keep Arkansas on more companies' short lists of potential locations for expansion,” Secretary McDonald said. “When businesses choose Arkansas, that means more opportunities for higher wages and brighter futures for Arkansans and their families. It means fewer Arkansans have to leave the state for jobs, and more people come here and call The Natural State home.”

Once the new rate changes take effect on January 1, 2024, Arkansas taxpayers will begin to benefit from the cuts and see their tax liability decrease. In addition to the tax cuts, some Arkansas taxpayers will receive a one-time $150 tax credit.

The new tax cuts are a major win for Arkansas that will have long-term positive impacts on our state and Arkansans. AEDC has a strong pipeline of economic development projects, and this adds one more tool to our arsenal when it comes to promoting Arkansas as the best place for companies to do business.

|

|