How the CHIPS Act Can Impact Arkansas

April 04, 2023In late 2019 and early 2020, as the world was grappling with the spread of COVID-19, another global crisis was lurking just behind it. A series of natural disasters, pandemic-related lockdowns, and logistics failures brought the world’s semiconductor supply chain to a grinding halt. Consumers could not purchase vehicles, and news began to break of auto manufacturer lots full of cars, ready to drive, lacking only the chips enabling the vehicles’ advanced electronic systems. Parents and schools could not purchase the laptops and tablets that children needed to participate in remote schooling. These are among the mildest examples of how the chip shortage impacted our daily lives.

The public slowly became aware that the world’s supply of semiconductors, or chips, was almost entirely being funneled through one company- the Taiwan Semiconductor Manufacturing Company (TSMC). Some of us would later learn about the history of this company and the decades of tireless work from broad stakeholders that led to its success. The fragility of our supply chain became increasingly apparent.

U.S. lawmakers got to work and crafted a few pieces of legislation to address the issue – the Endless Frontier Act, which evolved into the United States Innovation and Competition Act (USICA), was a bipartisan, bicameral solution presented in May 2020. Concurrently, former Secretary of State Keith Krach was busy negotiating terms with TMSC to keep the chips flowing. The CHIPS for America Act was introduced in June of 2020, also with bipartisan support. These bills were merged into what became the CHIPS and Science Act (HR 4346), which was ultimately signed into law in August of 2022.

The Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America and Science Act, or CHIPS+, is a sprawling piece of legislation that includes a range of strategies and programs to strengthen our domestic supply chain and workforce. CHIPS+ also earmarks more than $52 billion in Federal funding from 2023 through 2027 for those programs and strategies. The 2023 funding was finally approved in December 2022 with the passage of the FY23 Omnibus Appropriations bill, and Federal agencies are buzzing right now in preparation for a variety of new funding programs, investments, and partnerships.

A series of major manufacturing investments have steadily been announced over the past two years, like Samsung’s plan to build a $17 billion semiconductor factory in Texas, and Intel’s goals to establish $20 billion operations in both Arizona and Ohio. Micron recently announced a $20 billion facility planned for New York. This has left many of us wondering, what about Arkansas?

You may be surprised to learn that there are more than 20 companies in Arkansas that manufacture semiconductors and related components. Arkansas is also home to a handful of appliance manufacturers, and dozens of companies that make other electronics and electronic components like relays, batteries, and wires. Ozark Integrated Circuits was founded in 2011 by Matt Francis after he received a PhD from the University of Arkansas. Since then, the Fayetteville-based company has steadily grown with investment from multiple federal agencies to prototype and fabricate semiconductors and circuits that can withstand extreme heat, extreme cold, and other hazards in space, on jet engines, or down wells exploring for energy. The company attributes its success to its ability to recruit and retain local engineering and microelectronics graduates, a “reversal of the high-tech brain drain,” as Ozark Integrated Circuits CEO Matt Francis has said.

“We have a one-time opportunity to muster Arkansas’ unique strengths to make a significant impact on the U.S. semiconductor supply chain and the lives of our people and communities. As manufacturing comes back to the U.S., industries like semiconductor and advanced electronics assembly will lead the way. Manufacturing 2.0 will need a workforce with skills like programming, automation, and data analytics whether we are designing or manufacturing electronics, packages and assemblies,” Francis said. "Arkansas is literally and figuratively positioned to make an enormous impact. Arkansas is a place known for making things and moving things. If we lay the groundwork for our workforce, we are right in the geographic center of the new IC facilities being planned and a natural place to integrate them. This kind of strategic cooperation is why critical industry like Aerospace has become our largest export, and we have the opportunity to expand this into semiconductors and their assembly.”

![]()

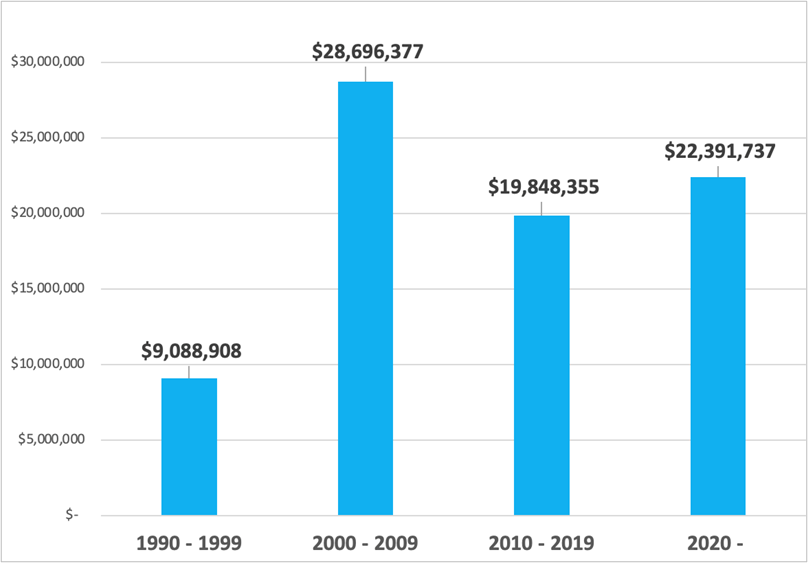

Arkansas also has a strong track record in semiconductor and microelectronics research dating back to the 1970s. The National Science Foundation alone has awarded more than $80 million to Arkansas colleges and universities for semiconductor-related research and education since 1990. This includes strategic investments like the Arkansas ASSET (Advancing and Supporting Science, Engineering and Technology) Initiative that supported a number of collaborative projects related to nanotechnology and microelectronics, as well as investments in 11 related startup ventures and private firms.

In Central Arkansas, Power Technology has been designing and manufacturing some of the most advanced lasers in the world for decades. “Lasers are an integral part of the semiconductor manufacturing process. We make high-quality lasers for to some of the world’s top manufacturers with a variety of applications,” Walter Burgess, co-CEO of Power Technology shared. “Lasers are critical to several processes of semiconductor fabrication, including laser lithography which is a common manufacturing technique for chips.”

The final concept to provide context and better understanding of the impact of the CHIPS+ Act for Arkansas is related to EPSCoR. The Established Program to Stimulate Competitive Research, or EPSCoR began at NSF in 1979, as a response to huge geographic disparities in federal research and development investments, which persist today. For example, of the $134 billion in federal R&D investments in FY19, $84.3 billion (around 63%) went to just 10 states. 26% of that $134B went to just Maryland and California. Considering this is funded by taxpayers across the country, lawmakers wanted to see a little more equity in those investments. Other federal agencies implemented EPSCoR over time, and now EPSCoR exists at NSF, NIH, NASA, DOE, USDA, and DOD. Each agency has its own formula to determine eligibility for EPSCoR. At NSF, states are eligible for EPSCoR if they receive less than 0.75% of NSF’s total investments in a given time period. That comes out to about $60 million, so states that are receiving more than $60 million per year in NSF awards are generally not eligible. Currently, 25 states plus 3 U.S. territories are eligible for NSF EPSCoR: Alabama, Alaska, Arkansas, Delaware, Guam, Hawaii, Idaho, Iowa, Kansas, Kentucky, Louisiana, Maine, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Oklahoma, Puerto Rico, Rhode Island, South Carolina, South Dakota, Vermont, US Virgin Islands, West Virginia, and Wyoming.

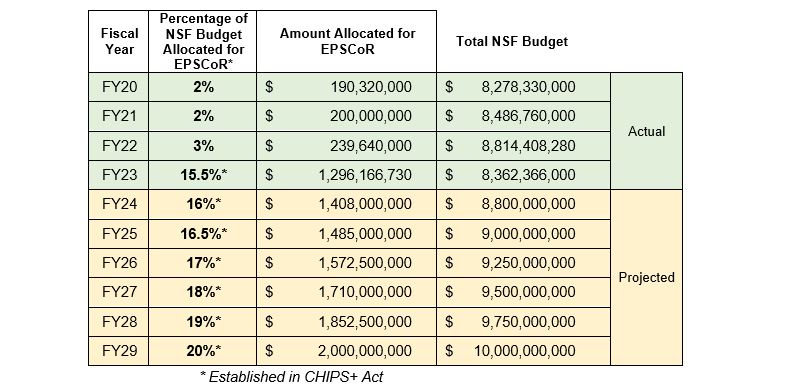

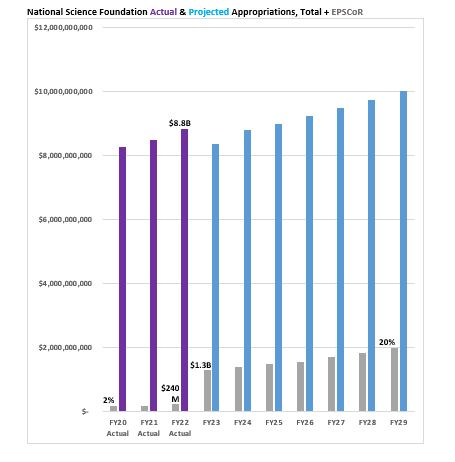

The CHIPS+ Act included a provision to significantly increase the amount of money that is reserved at NSF for investments in EPSCoR-eligible states, or jurisdictions. From 2020 – 2022, NSF allocated between 2% - 3% of its annual budget for the EPSCoR office. In FY22, that meant about $239 million out of the agency’s $8.8 billion total budget was reserved for those 28 eligible jurisdictions. The CHIPS+ Act mandates that in FY23, that allocation be raised to 15.5% of the agency’s budget, with increases annually through FY29, eventually reaching 20%. In dollars, that means that NSF is setting aside $1.2 billion for EPSCoR jurisdictions in FY23.

This component of the CHIPS+ Act is one of the more significant pieces that may impact our state’s economy. Arkansas is the only state that administers NSF EPSCoR from a state government agency. One of the advantages of housing the program at the Economic Development Commission is the ability to support commercialization of EPSCoR-funded research. Student and faculty researchers in Arkansas that were supported by NSF EPSCoR are responsible for at least 40 patents and 14 startup companies since 2007, including Ozark Integrated Circuits, Green Technology (formerly Infinite Enzymes), Biostrategies, Wolfspeed (Cree), WattGlass, Surftec, NuShores Biosciences, Nanocellutions, and Celludot. It is estimated that nearly 30% of all patents resulting from EPSCoR research nationwide have come from Arkansas. From 2007 – 2022, Arkansas has received $69M in NSF EPSCoR Track-1 awards, and provided $16.5M in matching state funds to support the projects. That investment enabled hundreds of participating researchers to secure an additional $150M in R&D funds, and publish more than 1000 peer-reviewed journal articles on their research. NSF EPSCoR has been a major contributor to R&D in Arkansas, and our innovation economy.

The other big opportunities coming from the CHIPS+ Act are the wide range of new and improved funding programs at federal agencies, including NSF, Department of Defense, Department of Commerce, Department of State, and Department of Energy. Between now and 2027, we will see an unprecedented amount of money available to fund R&D, innovation, and workforce programs. The CHIPS+ Act specifically designates over $52 billion in funding for these efforts over five years.

What will correct our course is broad partnerships, alliances of stakeholders, who are all willing to contribute something to work towards a shared goal. These partnerships will require involvement from academia, government, and the private sector. Federal funders are looking to invest in coalitions that will collaborate to solve complex problems in novel ways.

Some examples of these programs are the Strategic & Spectrum Missions Advanced Resilient Trusted Systems (S2MARTS) Microelectronics Commons, housed at the DOD Naval Surface Warfare Center. This program aims to establish a network of regional hubs designed to take prototypes from research labs into scalable fabrication, a pipeline referred to as ‘lab-to-fab.’ This program will invest in a variety of organizations and technical areas, including quantum technology, artificial intelligence, and others. The University of Arkansas collaborated with dozens of other colleges, universities, and private companies across the country to lead one submission and support another proposal submission for this program.

Another major focus at the federal level is the 3R’s of the U.S. supply chain: robustness, reliability and resiliency. Semiconductors are a major, important component of electronic systems, but they are not the only component. Electronic systems consist of electronic components that are attached to boards, encased in packages, interfaced with connectors, and controlled with embedded software. These systems are presently being assembled mostly in Asia, at places like Foxconn, a massive Taiwanese assembly and test company. If the efforts to boost production of semiconductors in the U.S. are successful, but the chips are shipped to Asia for assembly, the CHIPS Act objective of fixing the U.S. supply chain has not been achieved.

Assembly, supply chain, logistics - Arkansans know those. The Arkansas Department of Commerce plans to convene stakeholders to discuss exactly where Arkansas can set its sights, and how that might impact our economy. Some potential priorities are the CHIPS for America Workforce and Education fund, a new program that will be housed at NSF to boost the semiconductor workforce by an additional 90,000 people in the next two years. Arkansas businesses should explore the tax credits and other incentives in the CHIPS+ Act, like the new Advanced Manufacturing Investment Credit that offers a 25% tax credit to companies who invest in manufacturing semiconductors or specialized equipment used in the manufacturing process. Educators have access to $40 million annually to collaborate with higher ed and the Department of Energy’s national labs on education and workforce efforts. Another provision established a new STEM Teacher Corps pilot program that will operate under NSF for the next ten years to increase the number of PK-12 educators.

For more information on the specific programs and opportunities related to the CHIPS+ Act, check out our “Guide to the CHIPS+ Act for Arkansas Business,” and check back here for regular updates on what Arkansas is doing as a state to take advantage of these opportunities.

| Blog post contributed by: |